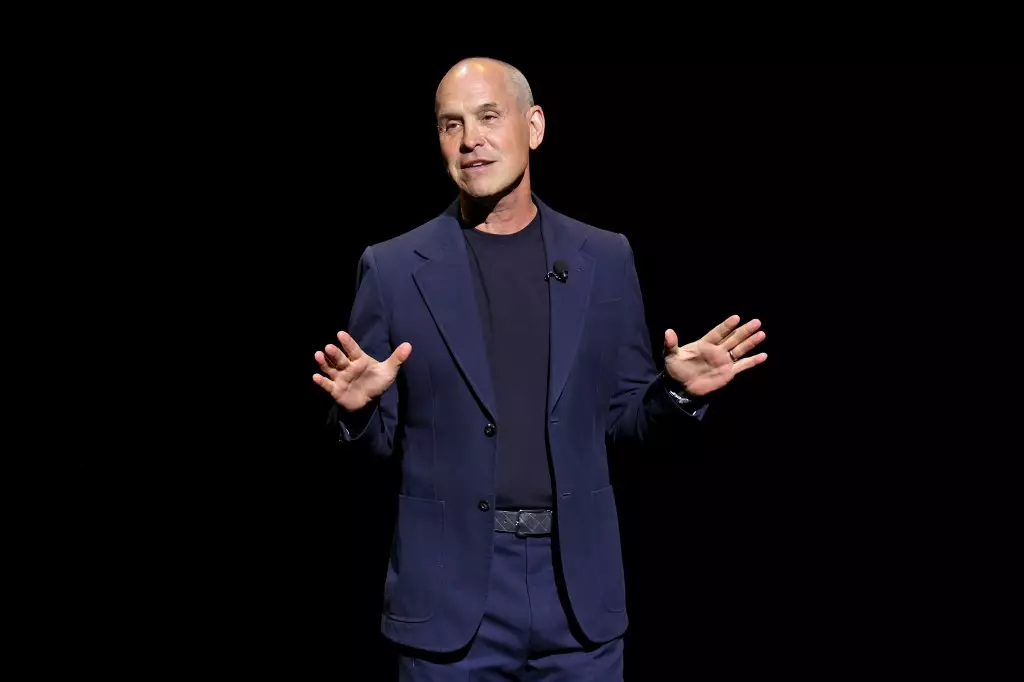

Paramount Pictures is currently at a crossroads as talks of a potential takeover by Skydance Media are looming large. The studio’s CEO, Brian Robbins, decided to take a lighthearted approach to the situation by joking about his colleague, Chris Aronson, raising money through a Kickstarter campaign to bid for the studio. This casual attitude towards such a significant development may raise concerns among stakeholders, especially considering the exclusive negotiating window with Skydance Media that Paramount currently finds itself in.

The Announcement of New Projects

Despite the uncertainty surrounding its future ownership, Paramount is not slowing down in terms of announcing new projects. In a recent presentation, the studio unveiled a diverse slate of upcoming films including a Trey Parker-Matt Stone original live-action comedy, a G.I. Joe Transformers crossover, an R-rated live-action Teenage Mutant Ninja Turtles movie, and a reboot of The Running Man starring Glen Powell. These announcements indicate that Paramount is focused on delivering engaging content to its audience, regardless of the ongoing takeover talks.

Skydance’s reported offer of $2 billion to buy out Shari Redstone’s stake in National Amusements Inc. (NAI), the majority shareholder of Paramount, has stirred up controversy among other investors. The proposed deal, which includes a separate all-stock acquisition of Skydance by Paramount worth $5 billion, has faced resistance from shareholders who feel that it unfairly benefits Redstone at the expense of others. Furthermore, the potential cash infusion into Paramount by David Ellison, with the backing of his father Larry Ellison and other investors, has raised concerns about the financial implications of the deal.

Shareholders of Paramount have been vocal in their opposition to the terms of the proposed takeover, with some even considering legal action to challenge the deal. The reported lack of consideration for common stockholders in comparison to the potential gains for Redstone has heightened tensions surrounding the acquisition. Additionally, industry observers are closely watching the developments, hoping that a more favorable outcome will emerge for Paramount and its stakeholders.

As Paramount navigates through the complexities of the takeover talks, there is a sense of uncertainty and anticipation about the studio’s future. The departure of certain board members and the ongoing financial challenges faced by the company further add to the intrigue surrounding its fate. The potential impact of Apollo’s reported offer and the conflicting interests of various stakeholders will undoubtedly shape the outcome of Paramount’s ownership transition.

Paramount’s current situation highlights the complexities and challenges associated with corporate takeovers in the entertainment industry. The studio’s ability to navigate through these turbulent waters will determine its long-term viability and success in an ever-evolving market. As stakeholders await further developments, the fate of Paramount hangs in the balance, with significant implications for the future of one of Hollywood’s most iconic studios.

Leave a Reply